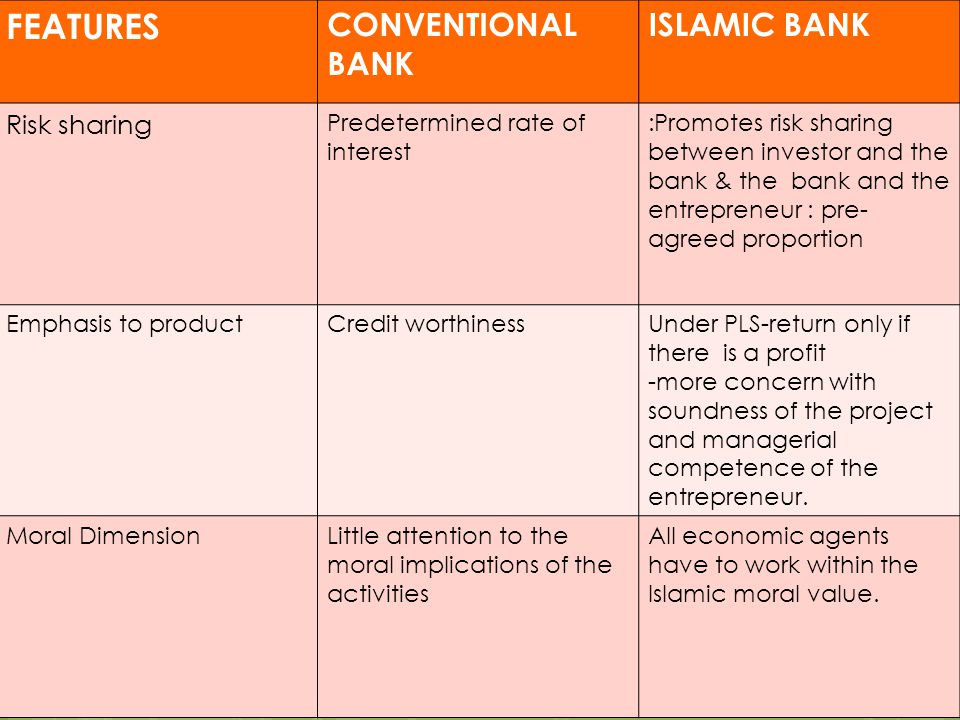

There are a number of key difference between the goods and services existing by a conventional bank in relationship to. Major Differences Between Islamic and Conventional Banking.

A Comparison Between Malaysia And Indonesia In Islamic Banking Industry Semantic Scholar

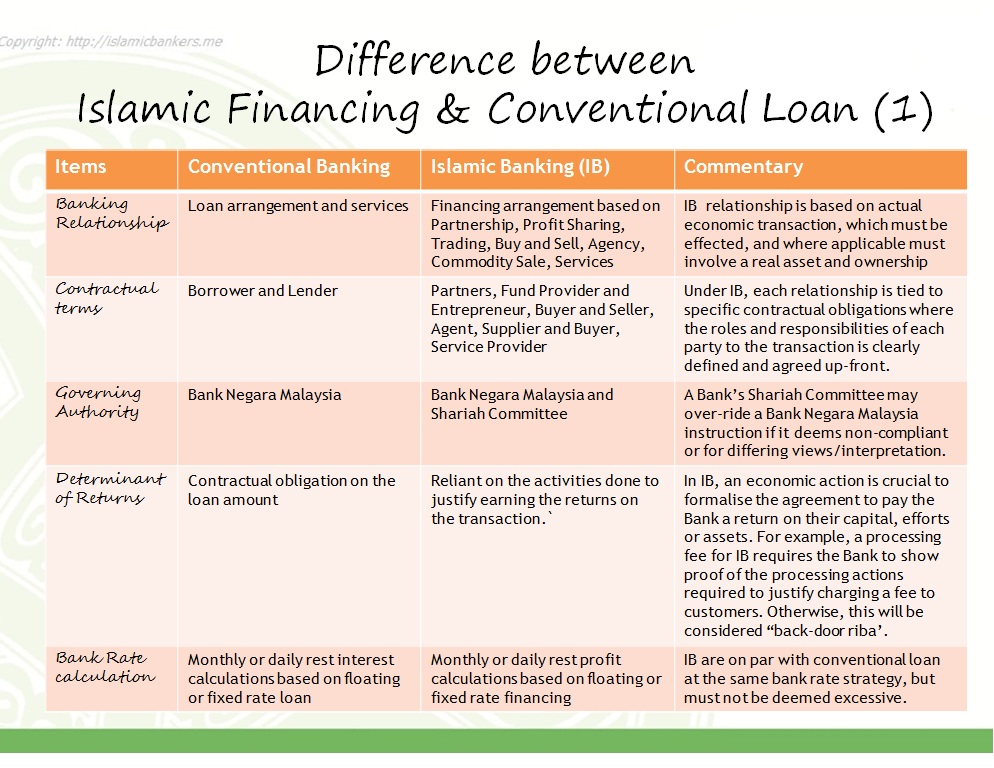

There really are differences between Islamic Banking and conventional banking and there are some of us trying very hard to make a difference in the compulsion towards.

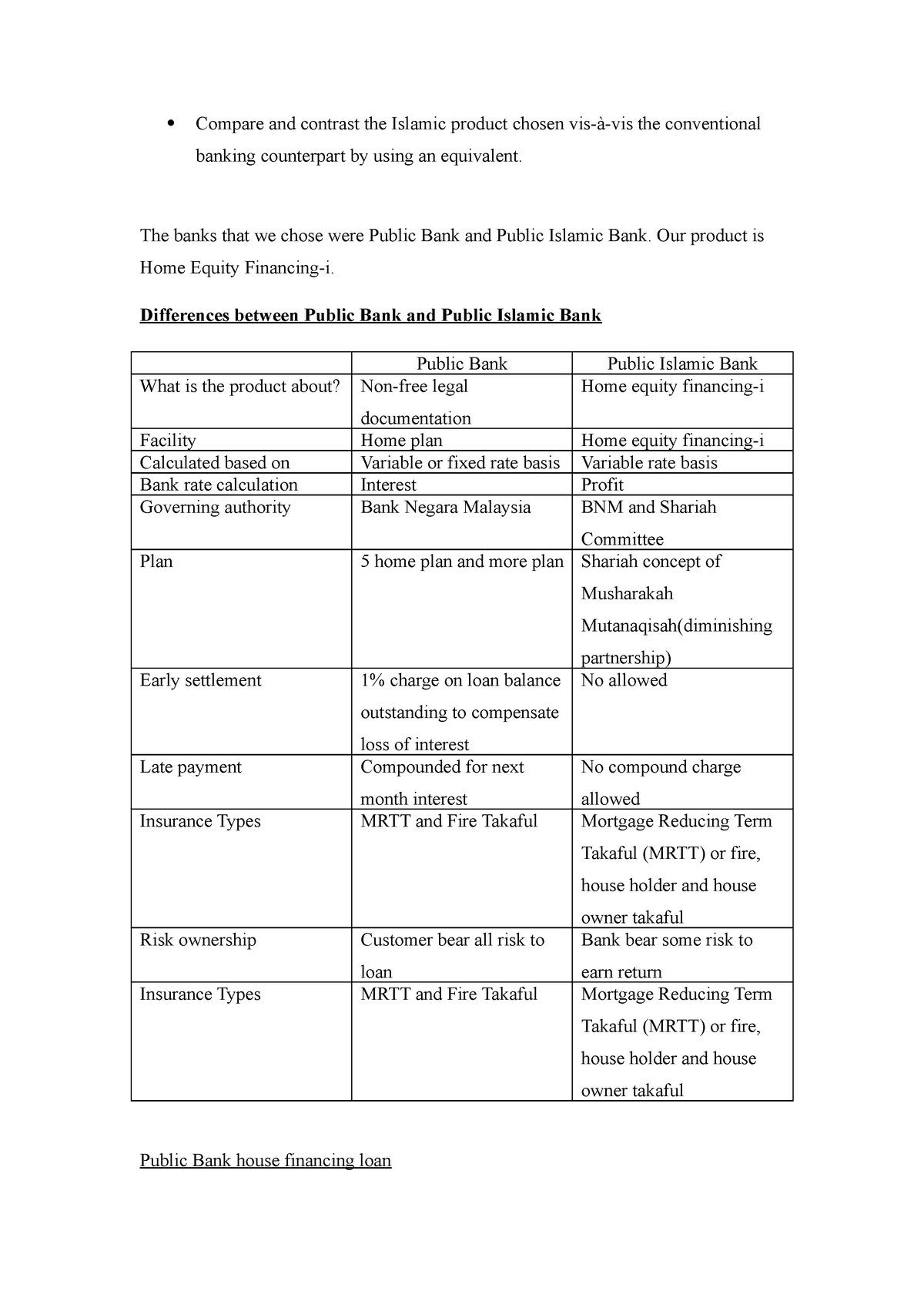

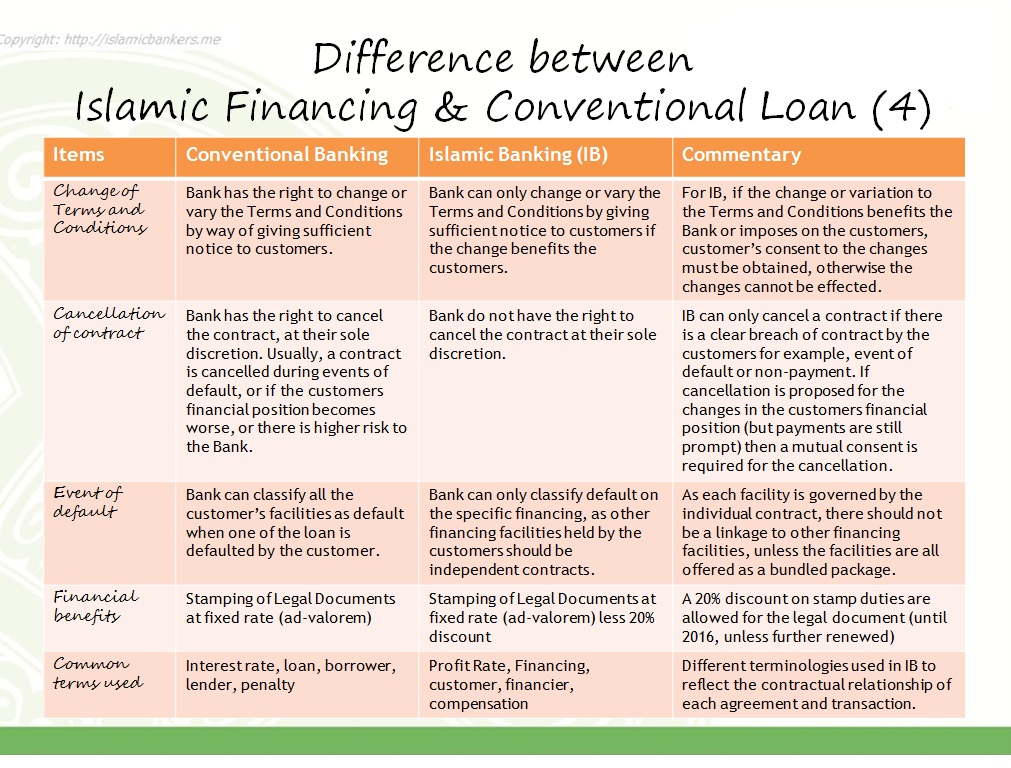

. Ust Hj Zaharuddin Hj Abd Rahman One must refrain from making a direct comparison between Islamic banking and conventional. In conventional financing there are only 2 legal. This is a simplified table to help you better understand the key differences between Islamic Personal.

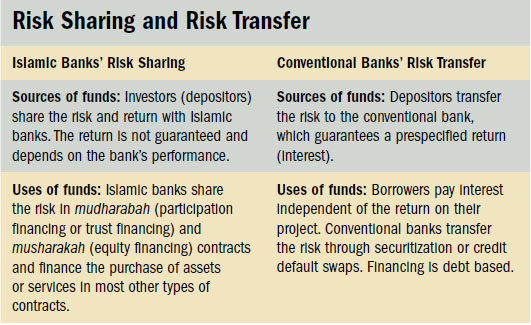

Real Asset is a. In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. Differences between Islamic Personal Loan Conventional Loan.

Thus all dealing transactions business approach product feature investment focus responsibility. By using our site you agree to our collection of information through the use of cookies. The main difference is that Islamic Banking is based on Shariah foundation.

Islamic banking in Malaysia is also covered under the Perbadanan Insuran Deposits Malaysia. In Islamic Banking on the other hand bank depositors receive their returns depending solely on the banks performance. Difference between Islamic and conventional banks.

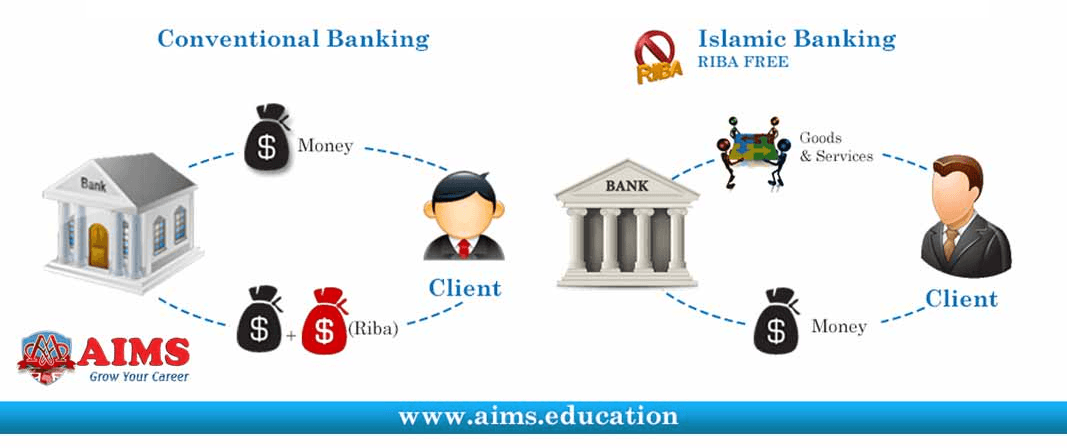

Unlike Conventional Banks an Islamic Bank acts. Based on the Malaysian Islamic Banking Act 1983 Islamic banking is a comprehensive and value-based system that aims to respect and enhance the moral and material wellbeing of. In conventional bank the relation between customer and banker is nothing but debtor and creditor.

The key contrast is that conventional banks earn their money by charging premuim and expenses for administrarions while Islamic banks acquire their cash by profit and loss sharing. Unlike Conventional Banks an Islamic Bank acts. Differences Between Islamic Bank and Conventional By.

Islamic banking products are usually asset backed and involves trading of. Mirza Ali Huzaifa Sultan. Conventional Bank treats money as a commodity and lend it against interest as its compensation.

Money is a product besides medium of exchange and store of value. The bank does not have the responsibility of profitloss of the customer. Comparative analysis of Islamic and conventional banking performance.

For an indefinite amount of time there will be a 20 stamp duty discount for Islamic Loan Agreement documents.

Islamic Banking Windows Islamic Bankers Resource Centre

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

The Difference Between Conventional And Islamic Fixed Deposits

Comparison Between Conventional And Islamic Banking Georgiartl

A Comparison Of The Financial Statements Of Conventional Banks Cbs Download Table

Islamic Vs Conventional Banks In The Gcc Blogs Televisory

Comparison Ib Compare And Contrast The Islamic Product Chosen Vis A Vis The Conventional Banking Studocu

Conventional Banking Islamic Bankers Resource Centre

Differences Of Components In Balance Sheet Of Islamic And Conventional Download Table

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Difference Between Islamic Banking And Commercial Banking Features

The Difference Between Islamic Banking Financing And Conventional Banking Loans Islamic Bankers Resource Centre

Fundamental Differences Between Islamic And Conventional Banking Download Scientific Diagram

Finance Development December 2010 Put To The Test

Punitive Pricing Islamic Bankers Resource Centre

What Is The Meaning Of Profit Rate Vs Interest Rate Comparehero

Islamic Banking Vs Conventional Banking Aims Uk